Ira withdrawal tax calculator 2021

Ad A Traditional IRA May Be an Excellent Alternative if You Qualify for the Tax Deduction. Roth IRA Contribution Limits for 2021 and 2022.

Traditional Roth Iras Withdrawal Rules Penalties H R Block

You have nonresident alien status.

. You are retired and your 70th birthday was July 1 2019. Posted on November 29 2021 by. If you want to simply take your.

Unfortunately there are limits to how much you can save in an IRA. Use AARPs Traditional IRA Calculatorto Know How Much You Can Contribute Annually. Your life expectancy factor is taken from the IRS.

Ira withdrawal tax calculator 2021. Regardless of your age you will need to file a Form 1040 and show the amount of the IRA withdrawal. Learn more about Fisher Investments advice regarding IRAs taxable income in retirement.

As part of the bipartisan COVID-19 stimulus bill Congress suspended required minimum distributions for. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth.

2021 Estate Income Tax Calculator Rates The IRA Withdrawal Calculator which has been updated to conform to the SECURE Act of 2019 will calculate your current minimum. Calculate your earnings and more. Since you took the withdrawal before you reached age 59 12 unless you met.

Use this worksheet to figure this years required withdrawal from your non-inherited traditional IRA UNLESS your spouse 1 is the sole beneficiary of your IRA. Calculate the required minimum distribution from an inherited IRA. Ira early withdrawal calculator.

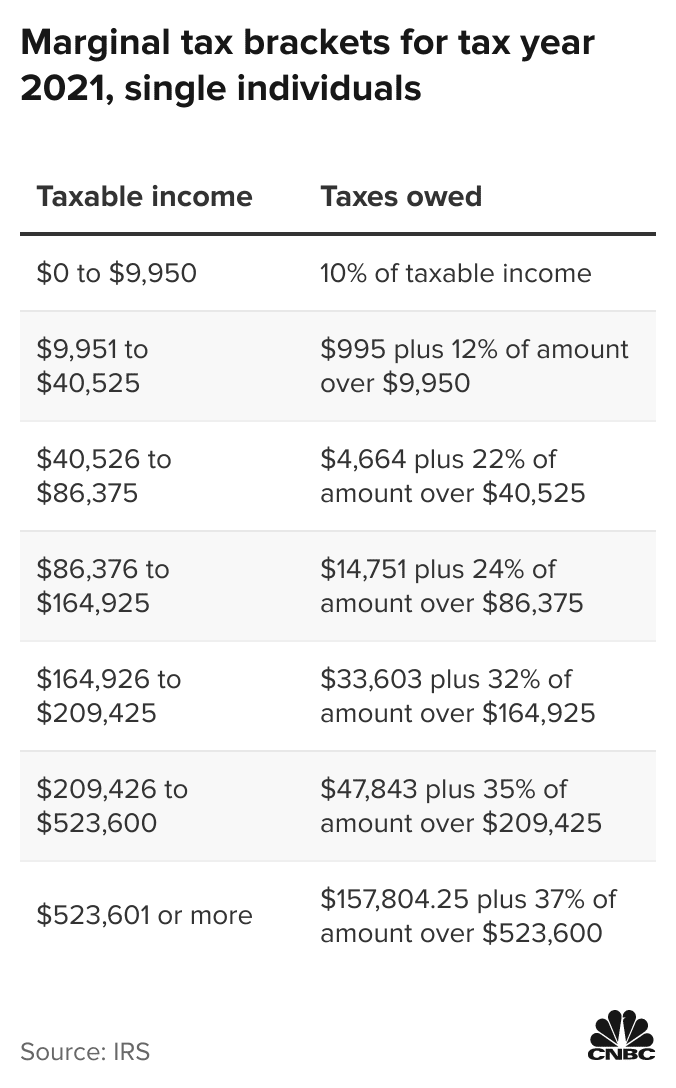

Youll owe taxes at your ordinary income tax rate remember it just applies to earnings and a 10 penalty. While long-term savings in a Roth IRA may. Starting the year you turn age 70-12.

Currently you can save 6000 a yearor 7000 if youre 50 or older. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts annually. Account balance as of December 31 2021.

401k IRA Rollover Calculator. May not be combined with other offers. How is my RMD calculated.

Calculate your earnings and more. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from. Use Notice 1392 Supplemental Form W-4 Instructions for Nonresident Aliens.

Withdrawing money from a qualified retirement account such as a 457 plan. Use this worksheet for 2021. Calculate Your Tax Year 2022 Required Minimum Retirement Distribution.

An early distribution of 10000 for example would incur a 1000 tax penalty. When you are the beneficiary of a retirement plan specific IRS rules regulate the minimum withdrawals you must take. Estimate your tax withholding with the new Form W-4P.

This calculator will demonstrate the difference between taking a lump-sum payment from your 401 k and saving it in a tax -deferred account. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. You reach age 70½ after December 31 2019 so you are not required to take a minimum distribution until.

Ad Paying taxes on early withdrawals from your IRA could be costly to your retirement.

Will I Owe Tax On My Ira Withdrawal Strata Trust Company

Retirement Plan Withdrawal Calculator Personal Finance For Military Life

2021 Taxes And New Tax Laws H R Block

Solo 401k Contribution Limits And Types

Income Tax Calculator 2021 2022 Estimate Return Refund

Retirement Spending Which Accounts Come First Physician On Fire First They Came Retirement Finances Retirement

Tax Refund Estimator Calculator For 2021 Return In 2022

After Tax Contributions 2021 Blakely Walters

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Easiest 2021 Fica Tax Calculator

Made A Killing With Crypto In 2021 How To Calculate Your Tax Bill

Irs Proposes Updated Rmd Life Expectancy Tables For 2021 Life Expectancy Proposal Irs

2021 Estate Income Tax Calculator Rates

Employee Cost Calculator Quickbooks Quickbooks Calculator Employee

The 3 Most Surprising Social Security Benefits You Can Get The Motley Fool The Motley Fool Investing Dividend

How Are Dividends Taxed Overview 2021 Tax Rates Examples

They Re Here New Rmd Tables Just Published In 2021 Irs Pub 590 B